Irs see part 3 - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Irs see part 3? On this page you'll find 346 study documents about Irs see part 3.

Page 3 out of 346 results

Sort by

-

VITA 2024 ADVANCED TEST QUESTIONS & ANSWERS LATEST 2024/2025 (GRADED)

- Exam (elaborations) • 8 pages • 2024

-

Available in package deal

-

- $12.49

- + learn more

Prior to working at a VITA/TCE site, ALL VITA/TCE volunteers (greeters, client facilitators, tax preparers, quality reviewers, etc.) must: - a. Annually pass the Volunteer Standards of Conduct (VSC) certification test with a score of 80% or higher. b. Sign and date the Form 13615, Volunteer Standards of Conduct Agreement, agreeing to comply with the VSC by upholding the highest ethical standards. c. Pass the Advanced tax law certification. d. All of the above. e. Both a and b <<<...

-

Florida Life, Health and Variable Annuities With Correct Solutions!!

- Exam (elaborations) • 15 pages • 2023

-

- $12.99

- 1x sold

- + learn more

Disability Buy-Out plans feature: - ANSWER Long elimination plans up to two years (A disability buy-out plan funded with disability insurance has a long elimination period of generally two years. The elimination period begins the day of the disability. Then the disability policy will provide a lump sum to buy the disabled partner out. They want to make sure that the partner is not going to recover and come back to work) When MUST the Office of Insurance Regulation conduct a market conduct exa...

-

TEST BANK FOR FEDERAL TAX RESEARCH 11th EDITION BY ROBY B. SAWYERS, STEVEN GILL | COMPLETE GUIDE | CHAPTER 1-19 2023-2024

- Exam (elaborations) • 159 pages • 2023

-

- $28.49

- + learn more

TEST BANK FOR FEDERAL TAX RESEARCH 11th EDITION BY ROBY B. SAWYERS, STEVEN GILL | COMPLETE GUIDE | CHAPTER 1-19 2023-2024. In the United States, the tax system is an outgrowth of the following five disciplines: law, accounting, economics, political science, and sociology. The environment for the tax system is provided by the principles of economics, sociology, and political science, while the legal and accounting fields are responsible for the system's interpretation and application. Each...

-

TEST BANK FOR FEDERAL TAX RESEARCH 11th EDITION BY ROBY B. SAWYERS, STEVEN GILL COMPLETE GUIDE | CHAPTER 1-19 2023-2024 | COMPLETE GUIDE

- Exam (elaborations) • 159 pages • 2023

-

- $30.49

- + learn more

TEST BANK FOR FEDERAL TAX RESEARCH 11th EDITION BY ROBY B. SAWYERS, STEVEN GILL COMPLETE GUIDE | CHAPTER 1-19 2023-2024 | COMPLETE GUIDE. Tax planning is the process of arranging one's financial affairs to minimize any tax liability. Much of modern tax practice centers around this process, and the resulting outcome is tax avoidance. There is nothing illegal or immoral in the avoidance of taxation, as long as the taxpayer remains within legal bounds. In contrast, tax evasion constitutes the i...

-

solution manual for South-Western Federal Taxation 2024 Essentials of Taxation Individuals and Business Entities, 27th Edition By Annette Nellen

- Exam (elaborations) • 374 pages • 2024

-

- $38.72

- + learn more

Test Bank for South-Western Federal Taxation 2024 Essentials of Taxation Individuals and Business Entities, 27th Edition By Annette Nellen Solution and Answer Guide: Nellen, Cuccia, Persellin, Young, SWFT Essentials of Taxation: Individuals and Business Entities 2024, 9780357900796; Chapter 1: Introduction to Taxation © 2024 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible 1 website, in whole or in part. Solution and Answer Guid...

-

AMCA CERTIFICATION TEST - MEDICAL ASSISTING STUDY GUIDE - SET A with Complete Solutions (2023)

- Exam (elaborations) • 36 pages • 2023

-

- $27.99

- 1x sold

- + learn more

AMCA CERTIFICATION TEST - MEDICAL ASSISTING STUDY GUIDE - SET A with Complete Solutions (2023) 1) Which of the following is considered a parasitic infection? A. Lyme disease B. Rabies C. Ringworm D. Malaria - ANSWER-D. Malaria 2) Aspirin and acetaminophen are examples of: A. Analgesics and antipyretics B. Antitussives and decongestants C. Antihistamines and antiemetics D. Antidotes and antibiotics - ANSWER-A. Analgesics and antipyretics 3) Demerol 75 mg, IM every 4 hours, as ne...

-

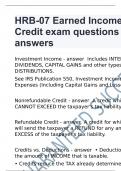

HRB-07 Earned Income Credit exam questions and answers

- Exam (elaborations) • 7 pages • 2024

- Available in package deal

-

- $12.99

- + learn more

Investment Income Includes INTEREST, DIVIDENDS, CAPITAL GAINS and other types of DISTRIBUTIONS. See IRS Publication 550, Investment Income and Expenses (Including Capital Gains and Losses). Nonrefundable Credit A credit which CANNOT EXCEED the taxpayer's tax liability. Refundable Credit A credit for which the IRS will send the taxpayer a REFUND for any amount in EXCESS of the taxpayer's tax liability. Credits vs. Deductions • Deductions reduce the amount of INCOME t...

-

solution manual for South-Western Federal Taxation 2024 Essentials of Taxation Individuals and Business Entities, 27th Edition By Annette Nellen

- Exam (elaborations) • 374 pages • 2024

-

- $39.83

- + learn more

Test Bank for South-Western Federal Taxation 2024 Essentials of Taxation Individuals and Business Entities, 27th Edition By Annette Nellen Solution and Answer Guide: Nellen, Cuccia, Persellin, Young, SWFT Essentials of Taxation: Individuals and Business Entities 2024, 9780357900796; Chapter 1: Introduction to Taxation © 2024 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible 1 website, in whole or in part. Solution and Answer Guid...

-

Pearson's Federal Taxation 2019 Corporations Partnerships Estates & Trusts 32nd Edition by Timothy J. Rupert - Test Bank

- Exam (elaborations) • 515 pages • 2023

-

- $22.75

- + learn more

Pearson's Federal Taxation 2019: Comprehensive, 32e (Rupert/Anderson) Chapter C1: Tax Research LO1: Overview of Tax Research 1) Tax planning is not an integral part of open-fact situations. Answer: FALSE Page Ref.: C:1-2 Objective: 1 2) When a taxpayer contacts a tax advisor requesting advice as to the most advantageous way to dispose of a stock, the tax advisor is faced with A) a restricted-fact situation. B) a closed-fact situation. C) an open-fact situation. D) a recog...

-

Auditing The Art and Science of Assurance Engagements, Fifteenth Canadian Edition, 15E Alvin Arens test bank

- Exam (elaborations) • 577 pages • 2024 Popular

-

- $35.86

- 1x sold

- + learn more

TEST BANK Akolisa Ufodike York University Auditing: The Art and Science of Assurance Engagements Fifteenth Canadian Edition Alvin A. Arens Michigan State University Randal J. Elder Syracuse University Mark S. Beasley North Carolina State University Chris E. Hogan Michigan State University Joanne C. Jones York University ISBN: 978-0-13-669229-4 Copyright © 2022 Pearson Canada Inc., Toronto, Ontario. All rights reserved. This work is protected by Canadian copyright laws and ...

That summary you just bought made someone very happy. Also get paid weekly? Sell your study resources on Stuvia! Discover all about earning on Stuvia