Child tax credit - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Child tax credit? On this page you'll find 1571 study documents about Child tax credit.

Page 3 out of 1.571 results

Sort by

-

H & R Block Income Tax Final Exam Review (New 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Graded A

- Exam (elaborations) • 31 pages • 2024

-

Available in package deal

-

- $10.99

- + learn more

H & R Block Income Tax Final Exam Review (New 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Graded A QUESTION If a taxpayer is subject to both the failure-to-file and failure-to-pay penalty, how is the combined penalty calculated? Answer: The failure-to-file penalty for that month is reduced by the failure-to-pay penalty for that month for a combined penalty of 5% of the unpaid taxes. QUESTION If a taxpayer receives an adjustment letter from the IRS...

-

HUD EXAM PREP| 120 QUESTIONS| WITH COMPLETE SOLUTIONS

- Exam (elaborations) • 28 pages • 2022

-

Available in package deal

-

- $10.49

- 1x sold

- + learn more

Types of Credit Used Correct Answer: Student loan or credit cards only FAKO scores Correct Answer: purchase score which are educational score Fair Credit Reporting Act FCRA Correct Answer: what is in file/dispute/remove 30 days/remove bad 7 yrs/bk 10 yrs/access limited/damages from violators/state rights Fair and Accurate Credit Transactions Act FACTA Correct Answer: free cbrs/fraud alert/truncate cc #s Fair Credit Billing Act (FCBA) Correct Answer: dispute bill error/mail 60 da...

-

CDFA Exam Study Materials Latest Update Graded A+

- Exam (elaborations) • 51 pages • 2024

-

- $11.99

- + learn more

CDFA Exam Study Materials Latest Update Graded A+ 5-year cliff vesting An employee who has at least five years of service must have a non- forfeitable right to 100% of the employee's accrued benefit [IRC §411(a)(2)(A)]. 3- to 7-year vesting (7-year graded vesting) An employee who has completed at least three years of service must have a non-forfeitable right to at least the following percentages of his or her accrued benefit: 20% after three years of service, 40% after four years o...

-

HRB FINAL EXAM QUESTIONS AND ANSWERS ALREADY PASSED

- Exam (elaborations) • 53 pages • 2024

- Available in package deal

-

- $11.99

- + learn more

HRB FINAL EXAM QUESTIONS AND ANSWERS ALREADY PASSED What is the Difference between earned income and unearned income? Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions alimony, unemploy...

-

Texas Life and Health Insurance Exam (question and answers) 2022/2023

- Exam (elaborations) • 19 pages • 2022

-

Available in package deal

-

- $9.99

- 23x sold

- + learn more

At what point must a life insurance applicant be informed of their rights that fall under the Fair Credit Reporting Act? - ANSWER Upon completion of the application Who elects the governing body of a mutual insurance company? - ANSWER policyholders An insurance applicant MUST be informed of an investigation regarding his/her reputation and character according to the - ANSWER Fair Credit Reporting Act What type of reinsurance contract involves two companies automatically sharing their ri...

-

H&R Block Specialist Test Questions & Revised Correct Answers

- Exam (elaborations) • 21 pages • 2024

-

- $12.99

- + learn more

H&R Block Specialist Test Questions & Revised Correct Answers 1. Sam pays his 19 yr. old son, Joshua, $550/month to maintain the lawn & garden at the family residence. Sam is subject to what household employment tax rules for Joshua? - ANSWER : A. Since Joshua is not performing any child case services, the household tax rules do not apply. B. Since Joshua is the taxpayer's child under age 21, the household employment tax rules do not apply. C. Since no evidence is given that Jos...

-

H & R Block Final Exam Review (Latest 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Grade A

- Exam (elaborations) • 27 pages • 2024

-

Available in package deal

-

- $10.99

- + learn more

H & R Block Final Exam Review (Latest 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Grade A Q: Devan and Amber adopted a child with special needs in a domestic adoption. They had $5,500 in qualified adoption expenses in 2023, and the adoption was finalized on December 18, 2023. Their modified adjusted gross income is $210,000. Assuming all requirements are met, what is the maximum adoption credit they can claim in 2023? a) $5,500 b) $14,300 c) $14,890 d) $20,390 ...

-

VITA 2024 ADVANCED TEST EXAM QUESTIONS AND ANSWERS LATEST UPDATE 2024/2025 (100% SOLVED)

- Exam (elaborations) • 13 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

VITA 2024 ADVANCED TEST EXAM QUESTIONS AND ANSWERS LATEST UPDATE 2024/2025 (100% SOLVED) What is the most advantageous filing status allowable that Joe can claim on his taxreturn for 2021? Head of Household Joe can claim a higher standard deduction because he is blind. True Chris and Marcie cannot claim the Earned Income Tax Credit (EITC) because theyare too young and have no qualifying children. false Chris and Marcie must claim the EIP3 of $2,800 as taxable income on their 2021 t...

-

HR Block Income Tax Midterm Exam (Latest 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Grade A

- Exam (elaborations) • 26 pages • 2024

-

Available in package deal

-

- $10.99

- + learn more

HR Block Income Tax Midterm Exam (Latest 2024/ 2025 Update) Questions and Verified Answers| 100% Correct| Grade A Q: Which of the following is not one of the four requirements to claim a dependent? D Answer: a) The dependent must be a qualifying child or qualifying relative. b) The dependent must be a U.S. citizen or a resident of the United States, Canada, or Mexico. c) If the dependent is married, they cannot be claimed as a dependent if they file a joint return with their spouse. ...

-

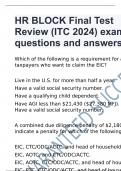

HR BLOCK Final Test Review (ITC 2024) exam questions and answers

- Exam (elaborations) • 31 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head ...

Study stress? For sellers on Stuvia, these are actually golden times. KA-CHING! Earn from your study resources too and start uploading now. Discover all about earning on Stuvia