And dependent credits - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about And dependent credits? On this page you'll find 489 study documents about And dependent credits.

Page 2 out of 489 results

Sort by

-

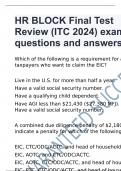

HR BLOCK Final Test Review (ITC 2024) exam questions and answers

- Exam (elaborations) • 31 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head ...

-

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition (2023-2024) By Nathalie Johnstone

- Exam (elaborations) • 1510 pages • 2024

-

- $37.49

- 1x sold

- + learn more

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition () By Nathalie Johnstone CHAPTER 1 Introduction Solution 1: Identify section of the Act The following summary is discussed in more detail below: Case Topic Part Division Subdivision Provision (A) Person ..................................................... XVII — — subsection 248(1) (B) Donation by individual............................ I E a subsection 118.1(3) (C) Balance-due day......

-

HR BLOCK Final Test Review (ITC 2022) Questions & 100% Verified Answers | Latest Update | Already Graded A+

- Exam (elaborations) • 33 pages • 2024

- Available in package deal

-

- $14.29

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). : Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head of hou...

-

H & R Block Midterm Review Questions With Complete Solutions

- Exam (elaborations) • 20 pages • 2023

-

Available in package deal

-

- $12.99

- + learn more

Some types of income do not need to be reported anywhere on a federal tax return. This includes all of the following EXCEPT: A.) Most medical insurance proceeds B.) Worker's compensation paid to an employee who was injured on the job. C.) Welfare benefits D.) Unemployment compensation correct answer: D.) Unemployment compensation Which of the following is considered earned income? A.) Interest from a bank account. B.) Unemployment compensation C.) Income from farming D.) Gambling Wi...

-

HUD EXAM PREP COMPLETE QUESTIONS & ANSWERS!!

- Exam (elaborations) • 21 pages • 2024

-

Available in package deal

-

- $13.99

- + learn more

Types of Credit Used - ANSWER Student loan or credit cards only FAKO scores - ANSWER purchase score which are educational score Fair Credit Reporting Act FCRA - ANSWER what is in file/dispute/remove 30 days/remove bad 7 yrs/bk 10 yrs/access limited/damages from violators/state rights Fair and Accurate Credit Transactions Act FACTA - ANSWER free cbrs/fraud alert/truncate cc #s Fair Credit Billing Act (FCBA) - ANSWER dispute bill error/mail 60 days/creditor 30 days acknowledge and 90 d...

-

H&R Block Midterm Review Questions with Complete Solutions

- Exam (elaborations) • 10 pages • 2024

- Available in package deal

-

- $9.99

- + learn more

H&R Block Midterm Review Questions with Complete Solutions Which of the following is considered earned income? C a) Interest from a bank b) Unemployment compensation c) Income from farming d) Gambling winnings The tax on income that comes entirely from wages under $100,000 is determined according to the: A a) Tax Tables b) Tax Computation Worksheet c) Qualified Dividends and Capital Gain Tax Worksheet d) Schedule D Tax Worksheet Which of the following shows these numbers round...

-

Payroll Fundamentals 1 Midterm Exam Q&A A+ Graded

- Exam (elaborations) • 12 pages • 2024

-

- $12.99

- + learn more

Payroll Fundamentals 1 Midterm Exam Q&A A+ Graded Commencement package (Ch.1) - CORRECT ANSWER--Organization specific forms (personal information forms) -Government forms (federal and provincial personal tax credits return) -Benefit forms (insurance enrollment forms) Hiring form (ch.1) - CORRECT ANSWER-May include information on their position such as department, manager, start date, salary/hourly wage, and benefit entitlement Information that must be provided to employees (ch.1) - CO...

-

HR BLOCK Final Test Review (ITC 2022)

- Exam (elaborations) • 16 pages • 2024

- Available in package deal

-

- $12.49

- + learn more

HR BLOCK Final Test Review (ITC 2022) Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). - ANS Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC...

-

HUD STUDY GUIDE EXAM AND 100% CORRECT ANSWERS 2024.

- Exam (elaborations) • 23 pages • 2024

-

Available in package deal

-

- $7.99

- + learn more

Types of Credit Used - Answer Student loan or credit cards only FAKO scores - Answer purchase score which are educational score Fair Credit Reporting Act FCRA - Answer what is in file/dispute/remove 30 days/remove bad 7 yrs/bk 10 yrs/access limited/damages from violators/state rights Fair and Accurate Credit Transactions Act FACTA - Answer free cbrs/fraud alert/truncate cc #s Fair Credit Billing Act (FCBA) - Answer dispute bill error/mail 60 days/creditor 30 days ackno...

-

WGU C237 Taxation I, Exam Questions and answers, 100% Accurate, VERIFIED 2024 | 29 Pages

- Exam (elaborations) • 29 pages • 2023

- Available in package deal

-

- $19.49

- + learn more

Define each component of the individual income tax formula - -income from whatever source derived exclusions=any item of income that the tax laws says is not taxable gross income=all income received in cash, property, and services from whatever source derived and from which the taxpayer derives a direct economic benefit deductions for AGI=expense one would see on an income statement (wages, repairs, depreciation) and some nonbusiness deductions (alimony, moving expenses, IRA contributions)...

How did he do that? By selling his study resources on Stuvia. Try it yourself! Discover all about earning on Stuvia