Dependent taxpayer test - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Dependent taxpayer test? On this page you'll find 215 study documents about Dependent taxpayer test.

All 215 results

Sort by

Popular

Popular

-

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition (2023-2024) By Nathalie Johnstone

- Exam (elaborations) • 1510 pages • 2024

-

- $35.49

- 2x sold

- + learn more

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition () By Nathalie Johnstone CHAPTER 1 Introduction Solution 1: Identify section of the Act The following summary is discussed in more detail below: Case Topic Part Division Subdivision Provision (A) Person ..................................................... XVII — — subsection 248(1) (B) Donation by individual............................ I E a subsection 118.1(3) (C) Balance-due day......

Popular

Popular

-

Test Bank for CCH Federal Taxation Comprehensive Topics Exam 2024 1st Edition by Harmelink Final Exam Study Guide with 100% complete solution

- Exam (elaborations) • 71 pages • 2024 Popular

-

- $19.99

- 2x sold

- + learn more

Test Bank for CCH Federal Taxation Comprehensive Topics Exam 2024 1st Edition by Harmelink Final Exam Study Guide with 100% complete solution 6 / 6 pts (TCO A) Which is not a source of federal revenue? Income taxes on Corporations Library Tax FICA taxes Estate and Gift Taxes Types of federal taxes include (1) income taxes on corporations, individuals, and fiduciaries, (2) employment taxes, (3) estate and gift taxes, and (4) excise and customs taxes. Also, revenues are generated from ...

-

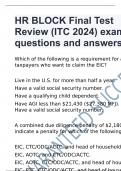

HR BLOCK Final Test Review (ITC 2024) exam questions and answers

- Exam (elaborations) • 31 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head ...

-

HRB FINAL EXAM QUESTIONS AND ANSWERS ALREADY PASSED

- Exam (elaborations) • 53 pages • 2024

- Available in package deal

-

- $11.99

- + learn more

HRB FINAL EXAM QUESTIONS AND ANSWERS ALREADY PASSED What is the Difference between earned income and unearned income? Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions alimony, unemploy...

-

REG Mnemonics Test Questions & Answers 2024/2025

- Exam (elaborations) • 16 pages • 2024

-

Available in package deal

-

- $9.49

- + learn more

REG Mnemonics Test Questions & Answers 2024/2025 Qualifying Child "CARES" - ANSWERSClose Relative: taxpayers son, daughter, stepson, stepdaughter, sister, brother, stepbrother, stepsister, or a descendent of any of these. Age Limit: younger than 19 or 24 if a full-time student that attends an educational institution for at least 5 months during the year. Individuals who are totally and permanently disabled Residency and Filing Requirements: same principal place as the taxpayer for m...

-

Grade A+ REG Mnemonics Exam Questions & Answers 2024/2025

- Exam (elaborations) • 19 pages • 2024

-

Available in package deal

-

- $9.99

- + learn more

Grade A+ REG Mnemonics Exam Questions & Answers 2024/2025 Dependency Exemptions - ANSWERS"CARES" & "SUPORT" -*C*lose Relative -*A*ge Limit (19/24=College) -*R*esidency and Filing Requirements (more than half yr) -*E*liminate Gross Income Test (Gross inc not included) -*S*upport Test Changes (More than half support) -*S*upport (over 50%) Test -*U*nder a specific amount of (taxable) gross income test (Taxable inc under std deduction) -*P*recludes dependent filing a joint tax r...

-

HRB FINAL EXAM STUDY GUIDE 2024 WITH CORRECT SOLUTIONS

- Exam (elaborations) • 23 pages • 2024

-

Available in package deal

-

- $12.49

- + learn more

What is the Difference between earned income and unearned income? - Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions alimony, unemployment compensation and other income that is not earned I...

-

HR BLOCK FINAL TEST - ACTUAL EXAM QUESTIONS WITH CORRECT ANSWERS AND RATIONALES UPDATED 2024/2025 (100% Correct)

- Exam (elaborations) • 21 pages • 2024

-

- $14.99

- + learn more

HR BLOCK FINAL TEST - ACTUAL EXAM QUESTIONS WITH CORRECT ANSWERS AND RATIONALES UPDATED 2024/2025 (100% Correct) the deduction for state and local income taxes is limited to what amount? - ANSWER-a. $10,000 ($5,000 if MFS). A married couple who materially participate in the operation of a jointly owned business may elect for each spouse to file their own Schedule C, with each reporting their respective amounts of income, loss, and deductions. This known as what? - ANSWERC. A qualified joint ...

-

HRB FINAL EXAM 2023-2024 COMPLETE QUESTIONS AND ANSWERS ASSURED A+.

- Exam (elaborations) • 23 pages • 2023

-

- $11.99

- + learn more

HRB FINAL EXAM COMPLETE QUESTIONS AND ANSWERS ASSURED A+. What is the Difference between earned income and unearned income? - Answer Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions ali...

-

HR BLOCK Final Test Review (ITC 2022)

- Exam (elaborations) • 16 pages • 2024

- Available in package deal

-

- $12.49

- + learn more

HR BLOCK Final Test Review (ITC 2022) Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). - ANS Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC...

That summary you just bought made someone very happy. Also get paid weekly? Sell your study resources on Stuvia! Discover all about earning on Stuvia