Fiscal law - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Fiscal law? On this page you'll find 2682 study documents about Fiscal law.

All 2.682 results

Sort by

Popular

Popular

-

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition (2023-2024) By Nathalie Johnstone

- Exam (elaborations) • 1510 pages • 2024

-

- $32.49

- 2x sold

- + learn more

Test Bank and Solution Manuals for Introduction to Federal Income Taxation in Canada, 44th Edition () By Nathalie Johnstone CHAPTER 1 Introduction Solution 1: Identify section of the Act The following summary is discussed in more detail below: Case Topic Part Division Subdivision Provision (A) Person ..................................................... XVII — — subsection 248(1) (B) Donation by individual............................ I E a subsection 118.1(3) (C) Balance-due day......

Popular

Popular

-

CLG 001_ Fiscal Law Exam version 2/ with 100% 2024 verified answers

- Exam (elaborations) • 20 pages • 2023 Popular

-

- $8.49

- 2x sold

- + learn more

QUESTION 1 1. Which of the following is a correct statement of Fiscal Law Philosophy: If the law is silent as to whether a purchase can be made, it is probably safe to spend appropriated funds. authorized by Congress. If the commander says buy it, don’t worry about Fiscal Law Regulations. Absent a specific prohibition, expending appropriated funds is permitted. 20 points QUESTION 2 1. It is July 2010. The contracting officer at Fort Mason is about to award a contract for a comput...

-

Fiscal Law Final Exam QUESTIONS AND ANSWERS RATED A+ 2023|2024 UPDATE

- Exam (elaborations) • 17 pages • 2023

-

- $10.49

- 3x sold

- + learn more

This study source was downloaded by from CourseH on :15:29 GMT -06:00 Fiscal Law Final Exam QUESTIONS AND ANSWERS RATED A+ 2023|2024 UPDATE QUESTION 1 1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False QUESTION 2 1. The proper amount of money to obligate at the award of a firm fixed- price contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. ...

-

Fiscal Law Test Questions with Correct Answers

- Exam (elaborations) • 5 pages • 2024

- Available in package deal

-

- $11.99

- 1x sold

- + learn more

Fiscal Law Test Questions with Correct Answers Fiscal Law - ANSWER Body of law governing use of federal funds Fiscal Year - ANSWER 1 October ‐ 30 September Period of Availability - ANSWER Most appropriations available for obligation for limited time period Funds not obligated in timely manner generally expire Obligation - ANSWER Transaction legally binding the government to make payment E.g., place an order, award a contract, receive services Budget Authority - ANSWER Federal law p...

-

Fiscal Law Final Exam - Questions and Answers

- Exam (elaborations) • 9 pages • 2023

-

- $10.49

- 1x sold

- + learn more

Fiscal Law Final Exam - Questions and Answers QUESTION 1 1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False QUESTION 2 1. The proper amount of money to obligate at the award of a firm fixedprice contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. A conservative amount based on the government’s estimated future requirements. QUESTION 3 1. How long does t...

-

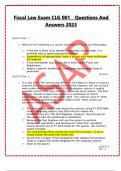

Fiscal Law Exam CLG 001 _ Questions And Answers 2023

- Exam (elaborations) • 13 pages • 2023

-

- $15.49

- 1x sold

- + learn more

Fiscal Law Exam CLG 001 _ Questions And Answers 2023 QUESTION 1 1. Which of the following is a correct statement of Fiscal Law Philosophy: If the law is silent as to whether a purchase can be made, it is probably safe to spend appropriated funds. Expenditure of appropriated funds is proper only when authorized by Congress. If the commander says buy it, don’t worry about Fiscal Law Regulations. Absent a specific prohibition, expending appropriated funds is ...

-

Test Bank for Issues in Economics Today, 10th Edition by Robert Guell

- Exam (elaborations) • 1065 pages • 2023

-

- $29.49

- 3x sold

- + learn more

Test Bank for Issues in Economics Today 10e 10th Edition by Robert Guell. ISBN-13: 0623 Full Chapters test bank are included Chapter 1: Economics: The Study of Opportunity Cost Chapter 2: Supply and Demand Chapter 3: The Concept of Elasticity and Consumer and Producer Surplus Chapter 4: Firm Production, Cost, and Revenue Chapter 5: Perfect Competition, Monopoly, and Economic versus Normal Profit Chapter 6: Every Macroeconomic Word You Ever Heard: Gross Domes...

-

Solution Manual for Government And Not For Profit Accounting Concepts And Practices 9th Edition Michael H. Granof|Latest Updated Version 2024 . A+

- Exam (elaborations) • 433 pages • 2024

- Available in package deal

-

- $13.49

- 2x sold

- + learn more

Solution Manual for Government And Not For Profit Accounting Concepts And Practices 9th Edition Michael H. Granof|Latest Updated Version 2024 . A+ Solution Manual for Government And Not For Profit Accounting Concepts And Practices 9th Edition Michael H. Granof Chapter 1 The Government and Not-For-Profit Environment Questions for Review and Discussion 1. The critical distinction between for-profit businesses and not-for-profits including governments is that businesses have profit as their...

-

CDFM Fiscal Law Exam || With 100% Accurate Solutions

- Exam (elaborations) • 13 pages • 2024

- Available in package deal

-

- $11.99

- + learn more

CDFM Fiscal Law Exam || With 100% Accurate Solutions CDFM Fiscal Law Exam || With 100% Accurate Solutions U.S. Fiscal Law - ANSWER - Body of law which governs the use and availability Federal funds by Executive Agencies Fiscal Law is derived from... - ANSWER - 1. US Constitution (Article I) 2. US Code, Title 31 3. FAR and subsequent regulations 4. GAO and court rulings Fiscal Year - ANSWER - Starts October 1 End September 30 Government Accountability Office (GAO) - ANSWER - An i...

-

Fiscal Law Module 3 Exam || Complete Questions & Solutions (Graded A+)

- Exam (elaborations) • 16 pages • 2024

- Available in package deal

-

- $12.49

- + learn more

Fiscal Law Module 3 Exam || Complete Questions & Solutions (Graded A+) Fiscal Law Module 3 Exam || Complete Questions & Solutions (Graded A+) Fiscal Law - ANSWER - Is the body of law which govern the availability and use of public funds. Same as appropriation law. Fiduciary Certifier - ANSWER - Responsible for use of appropriated funds as to the proper Purpose, Time, and Amount, and for those U.S. Codes pertaining thereto. Fund Certifying official. There is no relief from ADA violation. ...

-

Fiscal Law Exam 1 || Questions & Answers (100% Correct)

- Exam (elaborations) • 13 pages • 2024

-

- $12.49

- + learn more

Fiscal Law Exam 1 || Questions & Answers (100% Correct) Fiscal Law Exam 1 || Questions & Answers (100% Correct) "The established rule is that the expenditure of public funds is proper only when authorized by Congress," describes _____ - ANSWER - Affirmative Authority ______ has the ability to appropriate funds to be spent by the federal government. - ANSWER - Congress The three main elements that must be met before funds are obligated are - ANSWER - Purpose Time Amount To ap...

That summary you just bought made someone very happy. Also get paid weekly? Sell your study resources on Stuvia! Discover all about earning on Stuvia